Rental income received by Malaysian resident individuals not exceeding RM2000 per month for each residential home. B Determine the chargeable income for a year not including additional remuneration for the current month in accordance with the formula specified in subparagraph ci where P Y - K Y 1 K 1.

How To Do Pcb Calculator Through Payroll System Malaysia

Official Jadual PCB 2018 link updated.

. How Does Monthly Tax Deduction MTDPCB Work In Malaysia. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income. Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the same no matter the amount of income.

20182019 Malaysian Tax Booklet Income Tax. RETURN OF REMUNERATION FROM EMPLOYMENT CLAIM FOR DEDUCTION AND PARTICULARS OF TAX DEDUCTION UNDER THE INCOME TAX RULES DEDUCTION. Pioneer status PS and investment tax allowance ITA The PS incentive involves a tax exemption for 70 of statutory income 100 for certain activities for a period of five years which can be extended to a tax holiday of up to 10 years.

Employment Insurance Scheme EIS deduction added. Assessment YA 2018 to 2020 fully claimable within two years of assessment. The deduction is limited to 7per cent of your aggregate income.

The acronym is popularly known for monthly tax deduction among many Malaysians. Within 1 year after the end of the year the payment of withholding tax is made. Due date to furnish Form E for the Year of Remuneration 2018 is 31 March 2019.

This mechanism is designed to avoid the issues that come with requiring payment of a large sum of income tax when the actual tax amount has been determined. Removed YA2017 tax comparison. Receiving tax exempt dividends.

Annual Taxable Income Before Relief. Malaysia Monthly Salary After Tax Calculator 2022. Introduced PCB Schedule Mode where PCB amount will match LHDN PCB Schedule.

2 aKite Sdn Bhd Capital allowances CA for year of assessment 2018 CA RM RM 1Lorry Deposit 30000 ½ Instalments 4 months x RM7500 Working 30000 1 Qualifying expenditure QE60000 Initial allowance IA 20 12000 ½ Annual allowance AA 20 12000 24000 ½ Residual expenditure RE36000. If taxable you are required to fill in M Form. The calculator is designed to be used online with mobile desktop and tablet devices.

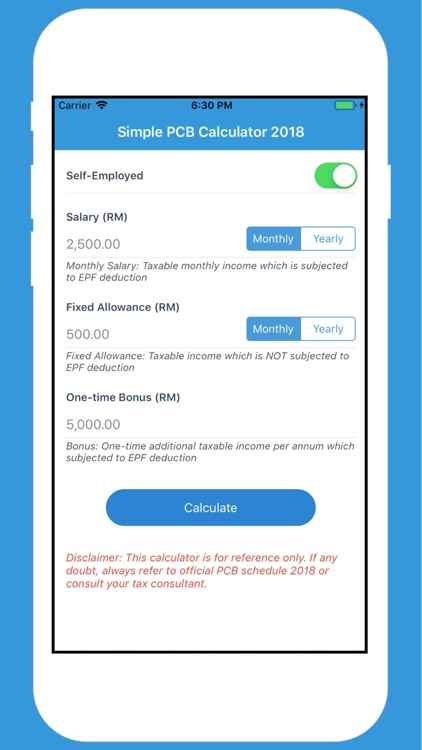

At the bottom of this section youll have to key in the total monthly tax deductions MTD paid during your year of assessment. This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay to RM402. 2018 About Simple PCB Calculator - PCB Calculator Made Easy Simple PCB Calculator is a monthly tax deduction calculator to calculate income tax required by LHDN Malaysia.

However since you are already paying income tax at a higher bracket every month via the monthly. Tax deduction not claimed in respect of expenditure incurred that is subject to withholding tax which is not due to be paid on the day the return is furnished. The amount of Monthly Tax Deduction based on Computerised Calculation is determined in accordance with the following formula.

- Monthly Tax Deduction PCB. The criteria to qualify for this tax exemption are. As a non-resident youre are also not eligible for any tax deductions.

Tax payment is made through mandatory monthly withholdings under the Monthly Tax Deduction Scheme MTDS. Monthly Tax Deductions MTD also known as Potongan Cukai Bulanan PCB in Malay is a mechanism in which employers deduct monthly tax payments from the employment income of their employees. PCB stands for Potongan Cukai Berjadual in Malaysia national language.

What comes as a surprise to many is the 50 tax exemption on rental income received by Malaysian resident individuals. Monthly Tax Deduction for the current month P M R B Z X n 1 Net Monthly Tax Deduction Monthly Tax Deduction for the current month zakat for the current month Where P Y K Y. However if you claimed a total of RM11600 in tax relief your chargeable income would reduce to RM28400.

Expat Tax Guides Read tax guides for expats provided by EY. Relevant Provisions of the Law 21 This PR takes into account laws which are in force as at the date this PR is published. Failure to submit the Form E on or before 31 March 2019 is a criminal offense and can be prosecuted in court.

12 tax deductions that are allowable to a resident individual in computing his chargeable income for a YA. An application for the tax exemption can be submitted to Talent Corporation Malaysia Berhad from 1 January 2018 to 31 December 2023. EIS is not included in tax relief.

22 The provisions of the Income Tax Act 1967 ITA related to this PR are section. 8 EPF contribution removed. A Determine the category of the employee.

MTD or Potongan Cukai Bulan PCB is the compulsory mechanism where employers deduct monthly tax payments from a taxable employees salary. All employers must deduct tax from cash. EPF tax relief limit revised to RM4000 per year.

Step 1 Determine the Monthly Tax Deduction on net normal remuneration for a year. Annual Taxable Income After Relief. Monthly Tax Deduction MTD or PCB Potongan Cukai Bulanan was introduced in January 1995 is a system of tax recovery where employers make deductions from their employees remuneration every month in accordance with the PCB deduction schedule.

Simple Pcb Calculator Malaysia On The App Store

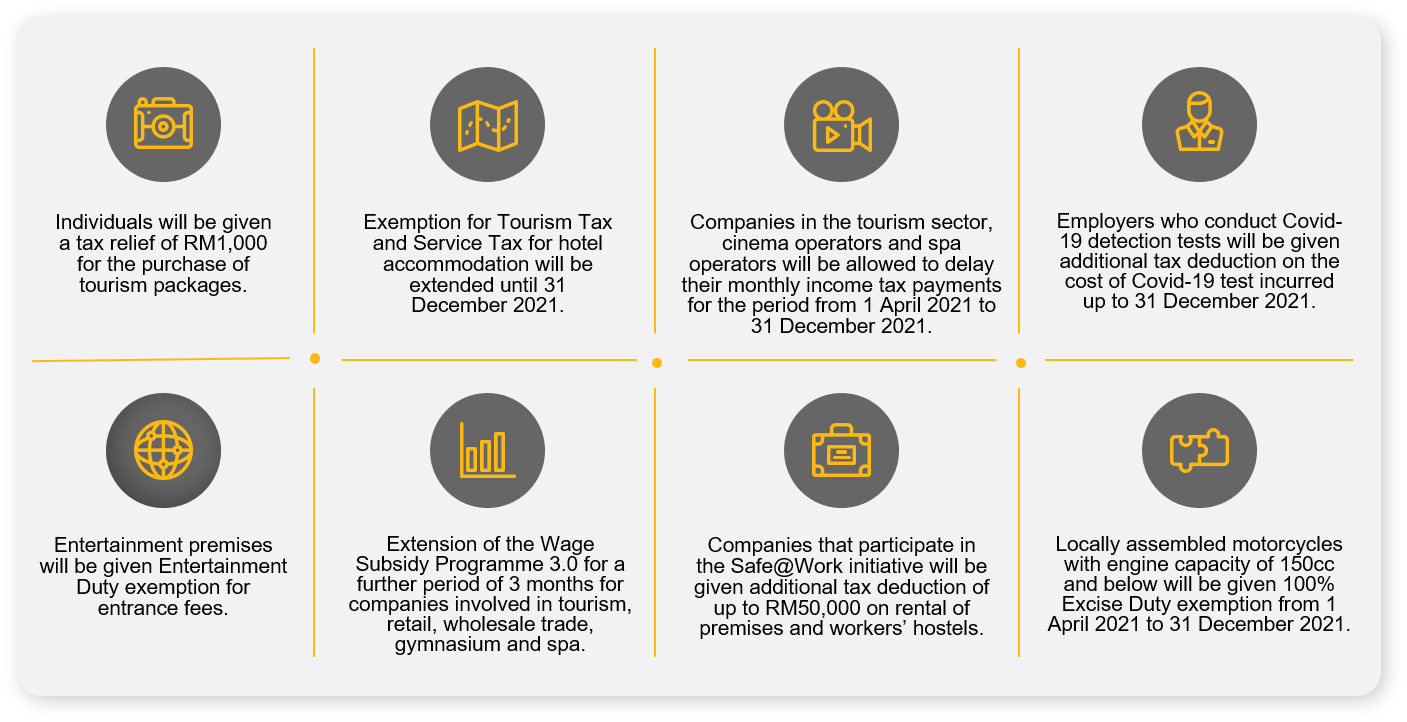

Pemerkasa Assistance Package Crowe Malaysia Plt

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Malaysia Payroll And Tax Activpayroll

North Carolina Providing Broad Based Tax Relief Grant Thornton

Download Simple Pcb Calculator Malaysia 2018 Apk Free For Android Apktume Com

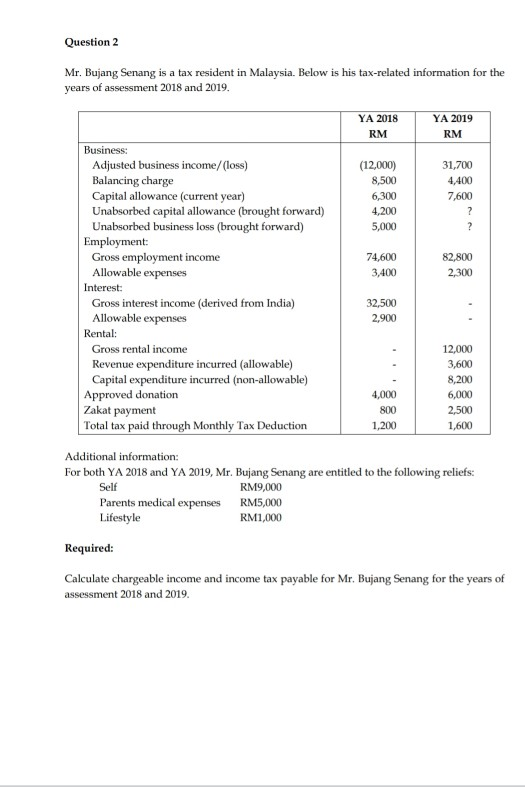

Question 2 Mr Bujang Senang Is A Tax Resident In Chegg Com

Pdf A Study On The Monthly Tax Deduction As The Final Tax Amongst Malaysian Salaried Taxpayers Theory Of Planned Behaviour Approach

St Partners Plt Chartered Accountants Malaysia Lhdn Specification For Monthly Tax Deduction Mtd Calculation Using Computerised Calculation For 2019 This Booklet Is To Provide Guideline And Mtd Verification Procedure

Income Tax Malaysia 2018 Mypf My

Malaysian Bonus Tax Calculations Mypf My

Lhdn St Partners Plt Chartered Accountants Malaysia Facebook

Download Simple Pcb Calculator Malaysia 2018 Apk Free For Android Apktume Com

Download Simple Pcb Calculator Malaysia 2018 Apk Free For Android Apktume Com

Simple Pcb Calculator Malaysia By Appnextdoor Labs

3 Ways To Do Bonus Calculation Pcb Without Payroll Software

Simple Pcb Calculator Malaysia By Appnextdoor Labs

How To Calculate Foreigner S Income Tax In China China Admissions